Some Ideas on Personal Loans Canada You Should Know

Some Ideas on Personal Loans Canada You Should Know

Blog Article

Not known Incorrect Statements About Personal Loans Canada

Table of ContentsSome Known Details About Personal Loans Canada The Greatest Guide To Personal Loans CanadaThe Best Strategy To Use For Personal Loans CanadaPersonal Loans Canada - An OverviewA Biased View of Personal Loans Canada

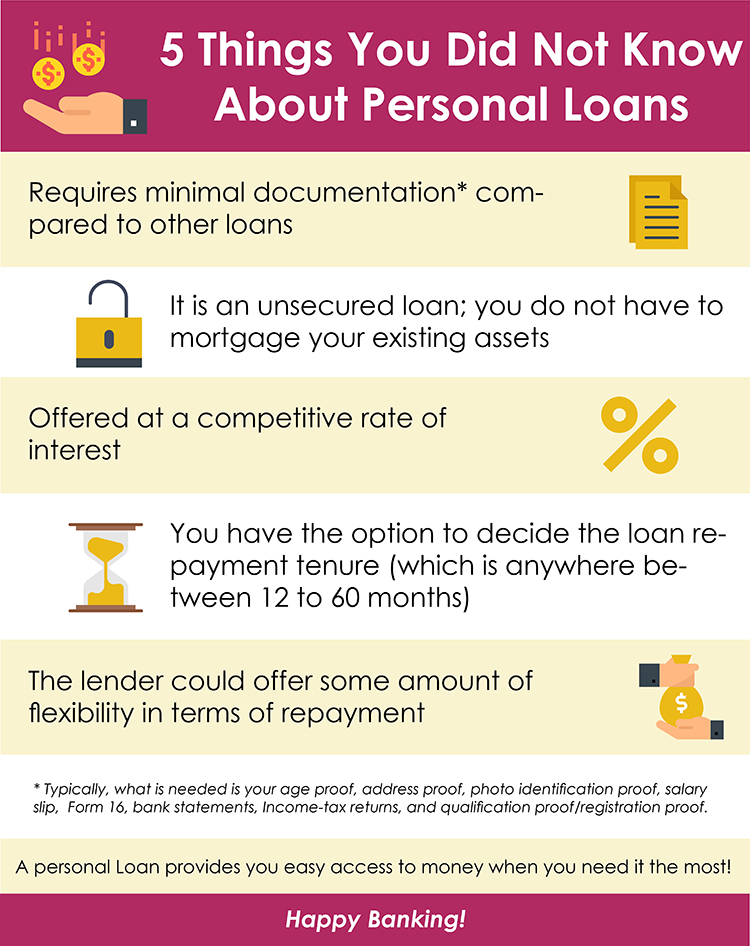

Repayment terms at most individual financing lenders vary in between one and seven years. You receive all of the funds simultaneously and can use them for virtually any kind of function. Customers typically utilize them to finance a property, such as an automobile or a boat, settle financial debt or help cover the expense of a major expense, like a wedding celebration or a home improvement.:max_bytes(150000):strip_icc()/pros-cons-personal-loans-vs-credit-cards-v1-4ae1318762804355a83094fcd43edb6a.png)

Individual loans featured a repaired principal and interest month-to-month settlement for the life of the finance, computed by accumulating the principal and the interest. A fixed price offers you the safety and security of a foreseeable month-to-month payment, making it a prominent selection for combining variable rate bank card. Payment timelines differ for individual financings, but consumers are typically able to choose payment terms in between one and seven years.

The Main Principles Of Personal Loans Canada

You may pay a preliminary origination fee of as much as 10 percent for an individual financing. The charge is normally subtracted from your funds when you finalize your application, minimizing the amount of cash you pocket. Personal car loans prices are more straight linked to short-term rates like the prime price.

You may be used a reduced APR for a much shorter term, since lending institutions recognize your balance will be paid off quicker. They might bill a greater price for longer terms knowing the longer you have a funding, the most likely something might alter in your funds that might make the payment unaffordable.

A personal finance is also a good option to utilizing credit scores cards, since you obtain cash at a fixed price with a certain reward date based upon the term you choose. Maintain in mind: When the honeymoon is over, the monthly payments will be a reminder of the cash you invested.

An Unbiased View of Personal Loans Canada

Prior to taking on financial obligation, utilize an individual car loan repayment calculator to help spending plan. Gathering quotes from multiple loan providers can help you spot the most effective offer and possibly save you interest. Contrast rate of interest, charges and lender online reputation before requesting the finance. Your credit history is a big consider determining your eligibility for the financing along with the passion rate.

Prior to using, recognize what your rating is to make sure that you recognize what to expect in terms of prices. Be on the hunt for concealed costs and fines by reviewing the loan provider's terms and conditions page so you don't end up with less money than you require for your financial objectives.

Individual finances need proof you have the credit scores profile and discover this earnings to repay them. Although they're easier to certify for than home equity financings or various other guaranteed finances, you still require to show the lending institution you have the means to pay the loan back. Personal loans are far better than bank card if you desire a set month-to-month payment and need every one of your funds at as soon as.

The Ultimate Guide To Personal Loans Canada

Credit history cards might also use benefits or cash-back choices that personal loans do not.

Some lenders may likewise charge fees for individual loans. Personal loans are car loans that can cover a number of personal costs. You can find personal fundings with banks, credit rating unions, and online lending institutions. Personal loans can be protected, indicating you require security to borrow cash, or unsafe, with no collateral needed.

As you invest, your offered credit scores is reduced. You can after that boost readily available credit rating by making a settlement towards your credit limit. With a personal financing, there's generally a fixed end day through which the car loan will be paid off. A line of credit, on the other hand, find more information might stay open and available to you forever as long as your account continues to be in great standing with your lending institution - Personal Loans Canada.

The money gotten on the loan is not strained. If the loan provider forgives the funding, it is taken into consideration a canceled financial obligation, and that quantity can be strained. A protected personal finance requires some kind of collateral as a problem of loaning.

3 Simple Techniques For Personal Loans Canada

An unsafe individual lending needs no collateral to obtain money. Banks, credit history unions, and online loan providers can provide both secured and unsafe individual loans to certified debtors.

Again, this can be a bank, lending institution, or on why not try here the internet personal loan lending institution. Usually, you would certainly initially complete an application. The lender examines it and makes a decision whether to approve or deny it. If accepted, you'll be given the loan terms, which you can accept or reject. If you consent to them, the following step is completing your car loan paperwork.

Report this page